Dubai real estate market: among the most fairly valued

Dubai real estate market: among the most fairly valued

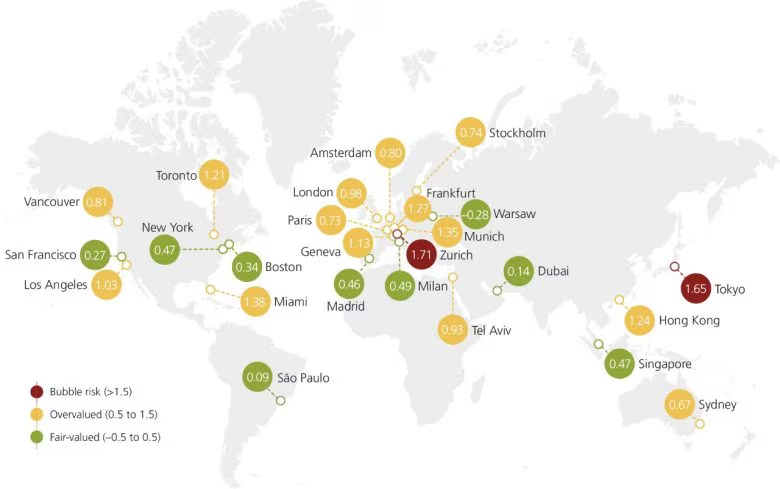

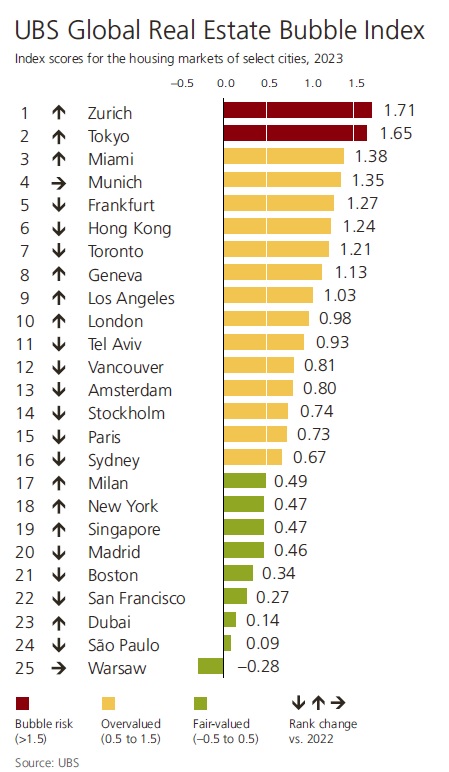

Dubai’s real estate market has been riding a wave of strong momentum in recent years. Fueled by robust economic growth, strategic government policies, and an increased influx of foreign investment, the real estate sector has reported significant gains. And, although there are risks that have the potential to temper this growth, as highlighted in the UBS Global Real Estate Bubble Index 2023, Dubai retains its position as one of the most fairly valued markets.

Which markets have the potential risk of becoming bubbles

No market is risk-free in times governed by uncertainty and geo-political tensions that have the potential to shake perhaps even the most rock-solid economies.

Inflation-adjusted home prices have nosedived amid the increasing interest rates, similar to the global financial crisis in 2008. Cities that had been classified in the bubble risk zone at least once in the past thirty-six months ended up recording an even stronger average price decline.

Buying owner-occupied real estate in Zurich now costs over 50% more than a decade ago in nominal terms. This growth has been driven by an influx of high-income buyers and persistently low interest rates. Despite recent hikes in borrowing costs, property prices have not yet aligned with these changes, placing the market in a bubble risk zone.

The popularity of buy-to-let during low interest rate periods led to an intensified correction when higher interest rates and declining profitability led to a surge in fire sales. Cities like Toronto and Frankfurt, where these factors aligned simultaneously, experienced a faster and more pronounced re-pricing.

In Miami, housing prices have surged at a faster rate than the national average, more than doubling in the last ten years. The city has reaped the benefits of the rising popularity of Sun Belt cities across the U.S. Continuous population growth and relatively affordable home prices compared to incomes have bolstered demand. However, recent increases in mortgage rates have led to a drop in sales and eased the upward pressure on prices.

Source: UBS report

Momentum for Real Estate in Dubai

Dubai real estate market: among the most fairly valued

According to data from UBS, Dubai’s real estate market continues to exhibit sustainable growth. The city has seen a surge in property prices, driven by several factors: fast post-pandemic recovery, with Dubai experiencing a rebound in tourism and increased business activity. The emirate’s favorable investment climate, including visa reforms and property ownership incentives for foreigners, has attracted significant overseas capital. Investors have flocked in here, a testimony to the increasing demand for high-end properties from wealthy international buyers seeking a luxury lifestyle and a safe investment haven.

According to UBS, these factors have pushed property prices up by over 15% year-on-year in prime areas, with luxury apartments and villas seeing the most substantial increases.

Capitalizing on diversified investment strategies

In an ever-changing geo-political landscape, savvy investors strategically approach their portfolios to help maximize returns. They do this by opting to diversify through property types (residential, commercial, and mixed-use) to offset any risks. Furthermore, they choose to invest in areas where they foresee growth potential, such as Dubai South, in the vicinity of the Al Maktoum International Airport, as well as the island in Ras Al Khaimah where the first casino will be completed in 2027. And, with rental prices increasing by over 20% year-on-year, properties in sought-after locations can provide attractive rental yields.

Dubai’s real estate market is currently brimming with investment opportunities. There is tremendous potential thanks to Dubai’s bullet-proof economy, strategic government policies, and increasing demand for luxury real estate, and also for affordable properties. What makes this destination extraordinary is the ability to capitalize on the emerging areas, as investors can harness Dubai’s real estate potential for significant returns. The city’s proactive approach to development, coupled with the investors’ appetite for new and better opportunities renders Dubai a beacon of opportunity on the global real estate horizon.