Dubai Real Estate Insights 2022

Dubai is a major global city and a major business hub in the Middle East. It is known for its high-rise buildings, luxury shopping centers, and iconic tourist attractions such as the Burj Khalifa, the world’s tallest building. The real estate market in Dubai is diverse and includes a range of property types, including residential, commercial, and industrial.

In recent years, Dubai’s real estate market has been fairly stable, with moderate growth in property prices. The market has been supported by strong demand from both local and international buyers and investors, as well as a robust economy and a favorable business environment. However, like any real estate market, it can be influenced by a range of factors such as economic conditions, supply and demand, and government policies.

Dubai Real Estate Insights 2022

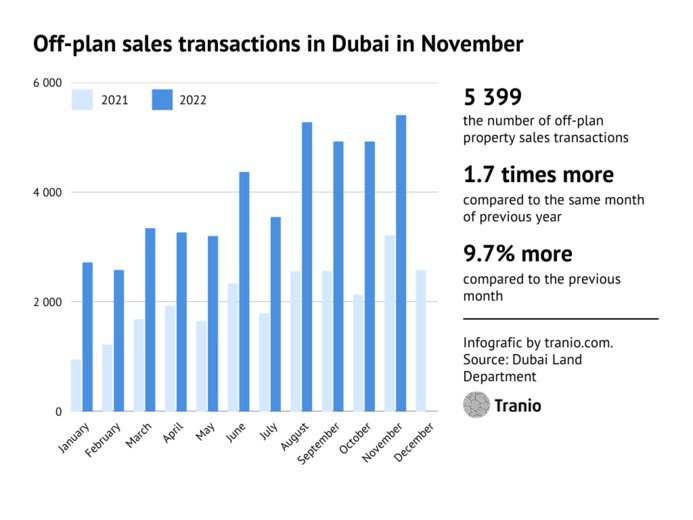

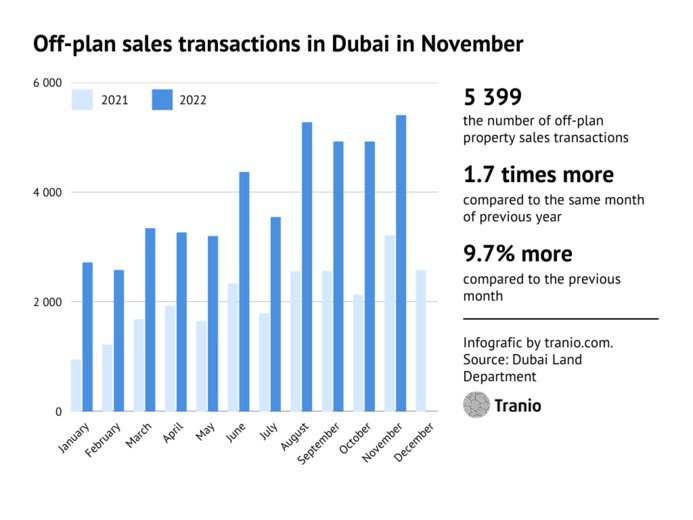

According to the Dubai land Department, the number of off-plan property transactions has reached a two-year high, reaching 5,399 in November 2022. The number of transactions increased 1.7 times over the same period last year. Last month, there were 4,918 off-plan transactions, which is 9.7% less than in November 2022.

Residential real estate in the UAE remains a top priority for international investors. Year to date (November 2022), the Dubai real estate market has seen a 46% increase in registered sales transactions, surpassing even the 2013 market peak by 38%. The market reached AED 240 billion, a 61% increase over 2021, primarily due to off-plan transactions, the value of which increased by 86% over the previous year. Off-plan sales accounted for 44% of total transactions in 2022, up from 40% in 2021. They accounted for 35% of total transaction value in 2022, reaching AED 83 billion, up from 30% in 2021.

Residential real estate in the UAE remains a top priority for international investors. Year to date (November 2022), the Dubai real estate market has seen a 46% increase in registered sales transactions, surpassing even the 2013 market peak by 38%. The market reached AED 240 billion, a 61% increase over 2021, primarily due to off-plan transactions, the value of which increased by 86% over the previous year. Off-plan sales accounted for 44% of total transactions in 2022, up from 40% in 2021. They accounted for 35% of total transaction value in 2022, reaching AED 83 billion, up from 30% in 2021.

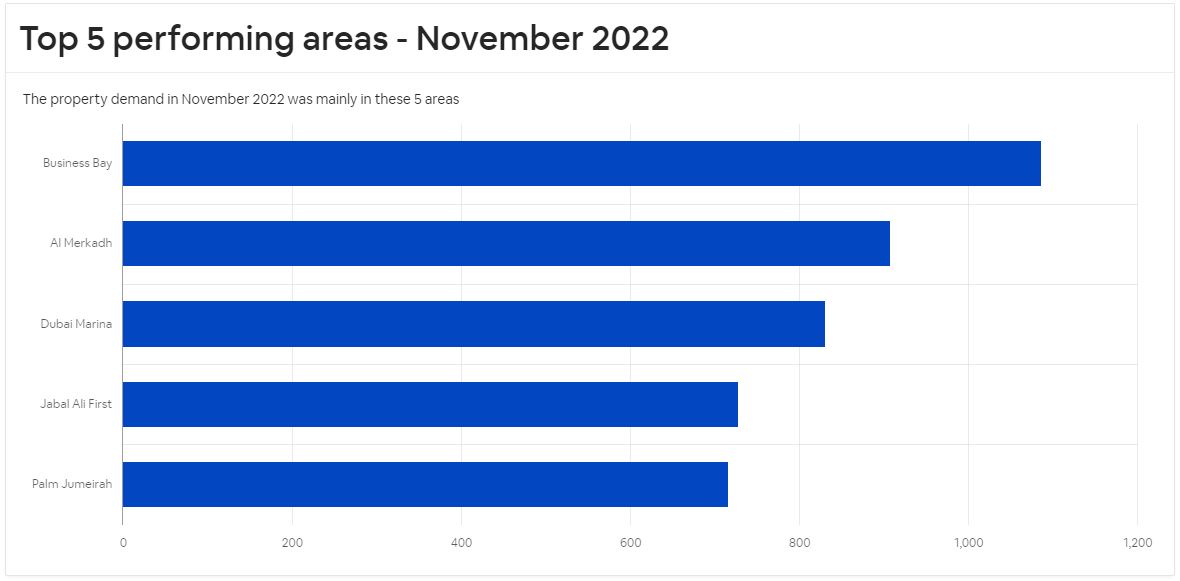

According to Data Finder, the Property Finder group’s real estate insights and data platform, apartment transactions dominated the market, accounting for 85% of total transactions, with villas/townhouses accounting for the remaining 15%. Dubai Marina, Downtown Dubai, Business Bay, and Palm Jumeirah are the top-performing areas for high-demand in apartments.

Dubai Hills Estate, Palm Jumeirah, Arabian Ranches, Arabian Ranches 2, DAMAC Hills (Akoya by DAMAC), Akoya, Mohamed Bin Rashid, and The Springs were the most searched localities for Villas/Townhouses.

The Dubai land department data shows a tremendous increase in the demand for properties in Business Bay. In November 2022, the sales value of off-plan residential property deals reached 3.7 billion US dollars, the highest figure in two years. Off-plan property transactions did not exceed 1.8 billion US dollars in the same period last year. The total volume of transactions in October 2022 was 3.4 billion US dollars, 8.7% less than in November 2022.

Off-plan property sales have traditionally accounted for a sizable portion of the Dubai real estate market, and this is likely to continue in the future. The overall state of the economy, the availability of financing, and government policies are all factors that can affect demand for off-plan properties in Dubai. In general, a strong economy and favorable lending conditions can lead to increased demand for off-plan properties, whereas economic downturns or tighter lending standards can dampen demand.

Buyers should carefully consider their decision to purchase off-plan property, as these sales can carry additional risks. For example, the final product may differ from the original plans, construction timelines may be pushed back, and market changes may affect the property’s value once completed. Before making a decision, buyers should conduct due diligence and carefully review the terms of any off-plan property purchase.