The extra costs of buying a house in Dubai in 2020

Owning a house in the United Arab Emirates used to be only a dream for most ex-pats. Fortunately, with the introduction of freehold property and with the decline of prices, mid-market housing options (and not only) became available for ex-pats to consider buying.

Why buying a house in Dubai is a good idea

Whether you are considering buying a property in Dubai to move into or buying property as an investment, you are probably a step closer to making better financial choices. Firstly, the cost of rent is comparable – if not higher – to the cost of paying installments on a mortgage loan. Secondly, owning property in a business center such as Dubai means good investing: you are investing for your future, whether you are holding it to sell it later on or you intend to earn by renting it. However, you need to know what are the extra costs of buying a house in Dubai.

What are the extra costs of buying a house in Dubai?

While all of the instances above are compelling when taking the decision to buy a home in Dubai, you should keep in mind and learn what are the extra costs of buying a house in Dubai. And there will be a handful of these, from the governmental fees paid to the Dubai Land Department (DLD) or the bank fees, which add up – unless you pay in cash – or the real estate agency fee. See each type of fees detailed below.

Government Fees

| Dubai Land Department Fees | – 4% of the purchase price + AED 580 admin fee for apartments and offices or AED 430 for land or AED40 for off-plan |

| Property Registration Fee | – For properties below AED 500,000: AED 2,000, plus 5% VAT

For properties above AED 500,000: AED 4,000, plus 5% VAT |

| DLD Mortgage Registration Fees | – 0.25% of loan amount + AED 290 |

In Dubai, property purchases must be registered with the Dubai Land Department within 60 days of the transaction, otherwise, they are declared invalid.

Real estate agency fees

Real estate agents deal with most of the hassle of matching a buyer with the home they want. For an additional cost of 2% of the purchase price plus VAT, you receive the best advice. The real estate agent puts you up to speed about the market and where it currently stands, about the community you are about to move into, and about the property itself and the developer.

Bank fees

| Property valuation fee | Ranges from AED 2,500 to AED 3,500, plus 5% VAT |

| Bank mortgage arrangement fee | Usually up to 1% of the loan amount, plus 5% VAT |

In case the property already has the seller’s mortgage registered, the buyer first needs to pay off the mortgage, in order to receive a No Objection Certificate (NOC) so that the property transfer can be processed by the DLD.

Other costs of buying a house in Dubai include bank fees, starting with the property valuation fee. As long as the transaction is completed through a mortgage, bank fees apply. In some cases, banks allow the buyers to add these extra costs to the mortgage in order to ease off the burden of initial costs.

Initial deposit

The buyer needs to make a deposit in order to secure the deal. The initial deposit is 10% of the value of the purchase price and is paid by check. The check will be staying with the RERA-authorized broker until the property is successfully transferred.

Service fees

Another category of extra costs of buying a house in Dubai is the service fees. This category refers to additional costs. Annual maintenance expenses for a property are paid to the DLD based on the RERA Service Charge and Maintenance index. This index determines the exact charge per square foot and varies depending on the community. This amount sums the charges for the common amenities of a building, such as an elevator, swimming pool, gym, or security.

Insurance fees

Life insurance is mandatory when taking a mortgage in the UAE, The cost of a life insurance policy is between 0.4% and 0.8% per year on the decreasing loan balance. Some banks will charge the life insurance fee monthly, while others will require it be paid in full on an annual basis.

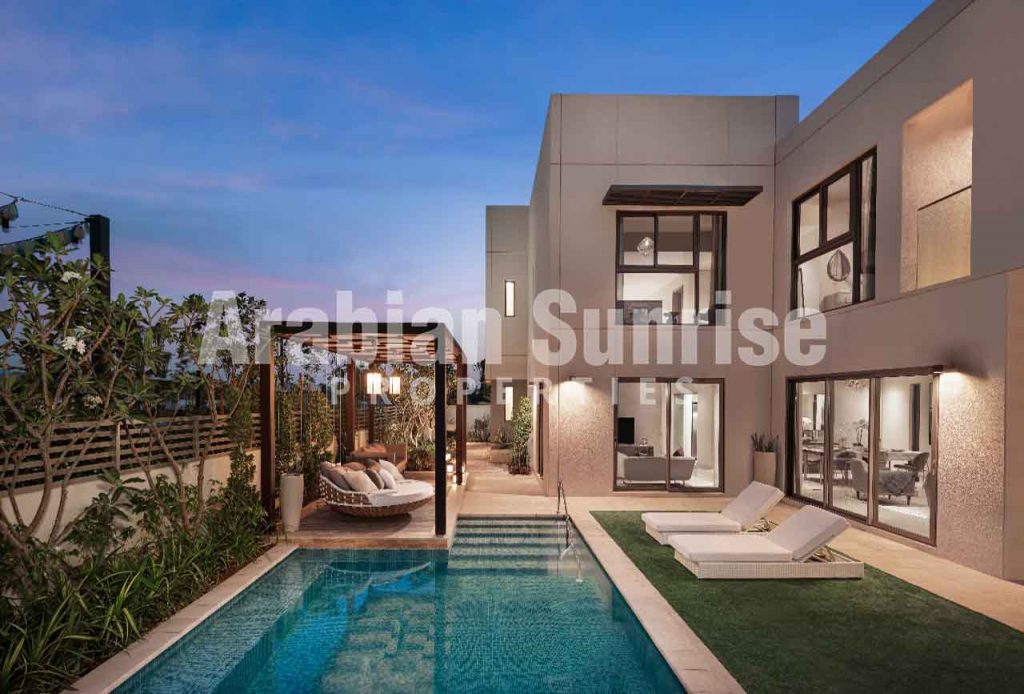

Now that you know what are the extra costs of buying a house in Dubai, it is much easier to make a decision. We, at Arabian Sunrise Properties, make it our job to assist you in finding the home of your dreams.

Take a look at our offer. We selected some of the best developers for you.

You are one closer to finding the community that matches your needs.